1) Stock picking by individuals is highly random with limited analysis. Don’t buy and sell on the basis of past pattern, every high-low has a new story and many factors. 2) Less turbulence , less stomach churn, less anxiety. Great Read More …

1) Stock picking by individuals is highly random with limited analysis. Don’t buy and sell on the basis of past pattern, every high-low has a new story and many factors. 2) Less turbulence , less stomach churn, less anxiety. Great Read More …

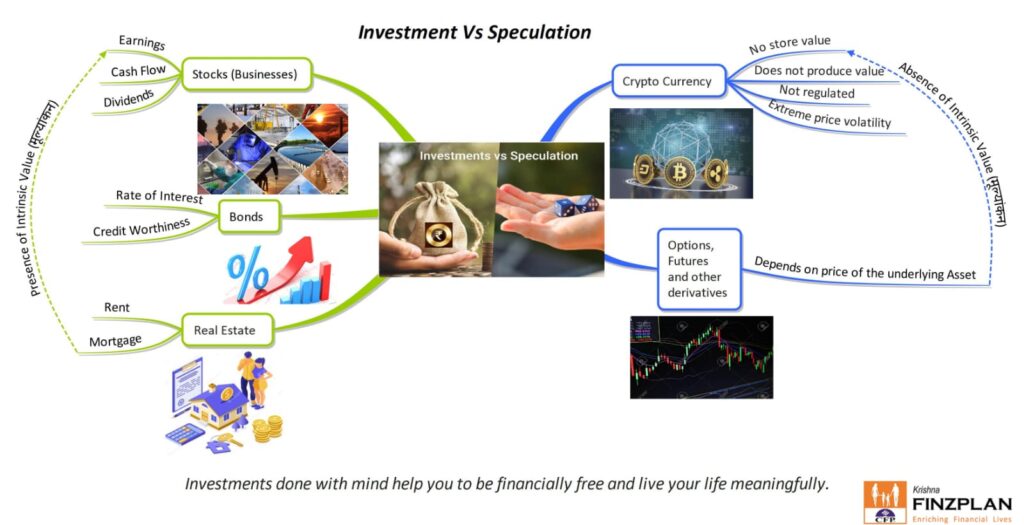

Presence of intrinsic value ( मूल्यांकन) = Investing ( 🖊️ , 📚 , 🧢 बेचने पर कुछ कीमत मिलती है।) Absence of Intrinsic Value ( Not product/currency to value) = Speculation We invest in below assets due to Intrinsic Value Read More …

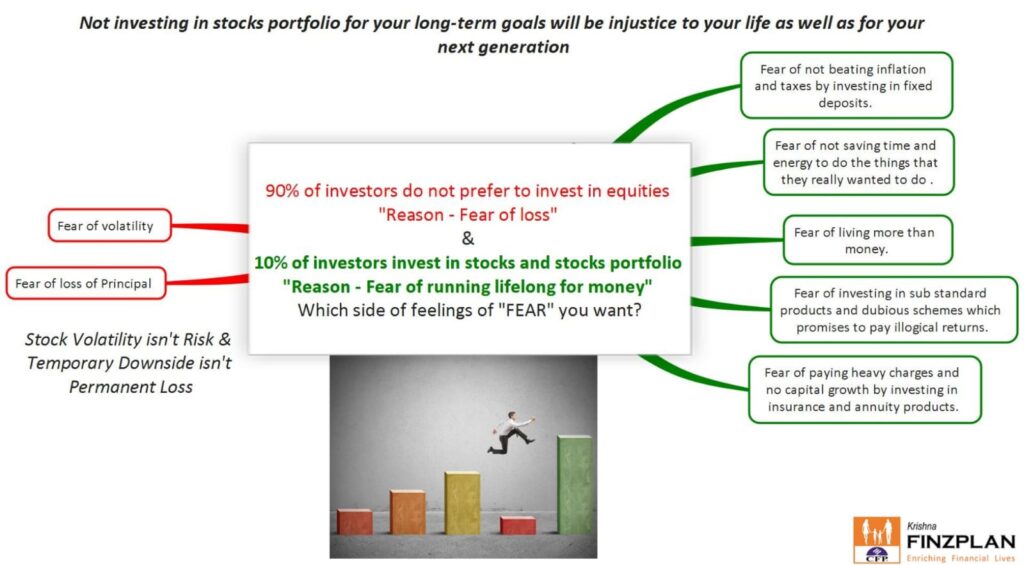

90% of investors do not prefer to invest in stocks or stocks portfolio – “Reason FEAR OF LOSS” Remaining 10% of investors who invest in stocks or invest in beautiful diversified portfolio of stocks via MF for self and family Read More …

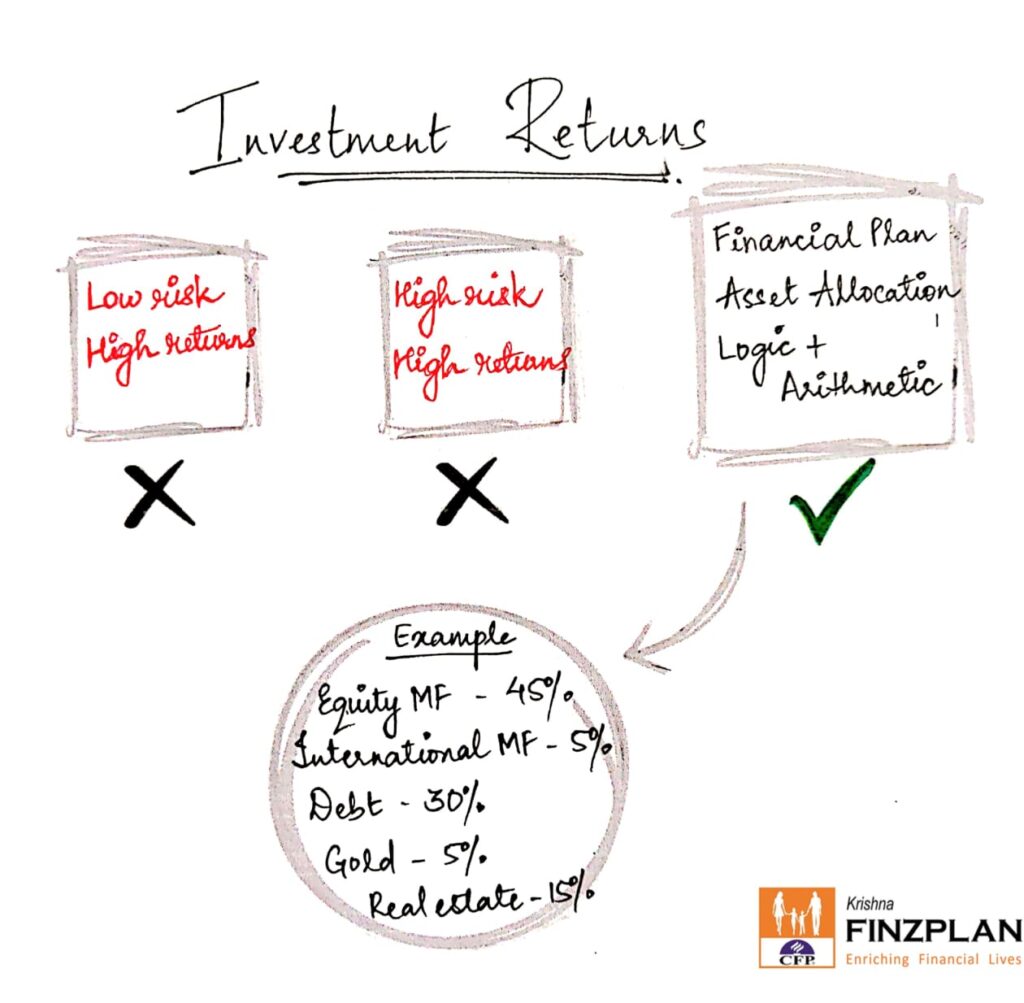

Investing should be with Plan +logic and spending should be with your emotions + values – Major returns of your total Investments come from asset allocation and not from your selection of an individual security within a asset class. Higher Read More …

We love uncertainty and fluctuations in Books and Films but when it comes to life we have a strong desire & belief of certainty. We want someone to tell us what the future will look like even though we know Read More …

Today, we will be going through the convictions of “Nick Murray” (Industry’s most respected Financial Advisor, writer and professional speaker with more than 50 yrs of experience) Conviction 1 – Nick believes that the main risk isn’t losing one’s money, Read More …

Build asset with optimism and Passion, not with fear – Asset is the only thing that will work for you lifelong. Focus on building it with utmost care. It’s the only way towards financial freedom. Your Income – Always depends Read More …

For financial success here on, people have to shift from a product-centric approach to their financial situation without mistakes. Too many expenses and loans: – India has one of the best saving rates as compared to western nations, but the Read More …

There is NO risk free returns in any assets Proper understanding of risk helps us to generate higher returns with the same amount of risk. There are mainly two types of risk: Systematic Risk – which exists in our system. Read More …

One should opt a habit of dividing Income as per below four parts to become financially free 1) Save for future – 25% 2) Household expenses – 25% Read More …